Why BS Fintech from SHU?

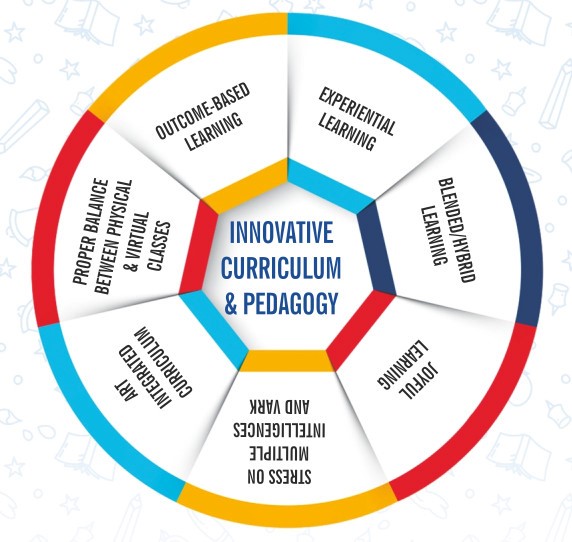

Innovative Curriculum: Salim Habib University offers a cutting-edge curriculum that integrates the latest advancements in fintech, ensuring students are well-versed in the most current technologies and trends.

Expert Faculty: The program is taught by experienced faculty members with a strong background in finance and technology, providing students with valuable insights and practical knowledge.

Industry Connections: The university has established strong ties with leading fintech companies and financial institutions, offering students networking opportunities, internships, and real-world experience.

State-of-the-Art Facilities: Students benefit from modern labs, technology resources, and a conducive learning environment tailored to the needs of fintech education.

Comprehensive Tracks: The program offers diverse tracks such as Digital Payments, Financial Data Analytics, and Blockchain, allowing students to specialize in areas that align with their career goals.

Career Support: Salim Habib University provides robust career services, including job placement assistance, career counseling, and support for entrepreneurial ventures.

Global Perspective: The university emphasizes a global outlook, preparing students to compete in the international fintech landscape and understand global financial trends.

Collaborative Learning: The program fosters a collaborative learning environment, encouraging teamwork and projects that simulate real-world fintech challenges.

Tracks Offered

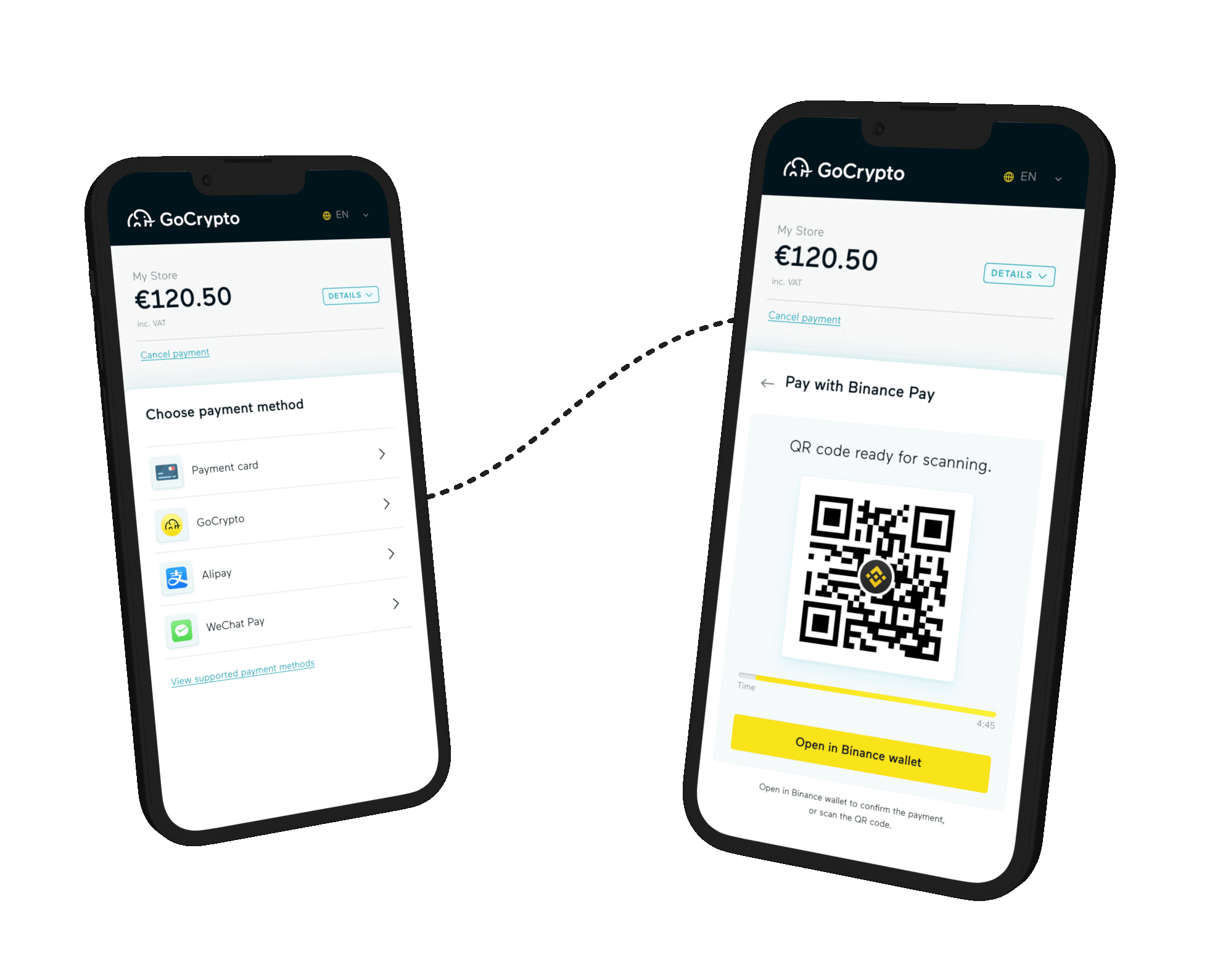

- Digital Payments and Cryptocurrencies

- Financial Data Analytics

- Financial Software Development

- Risk Management and Compliance

- Investment Technology (WealthTech)

- InsurTech (Insurance Technology)

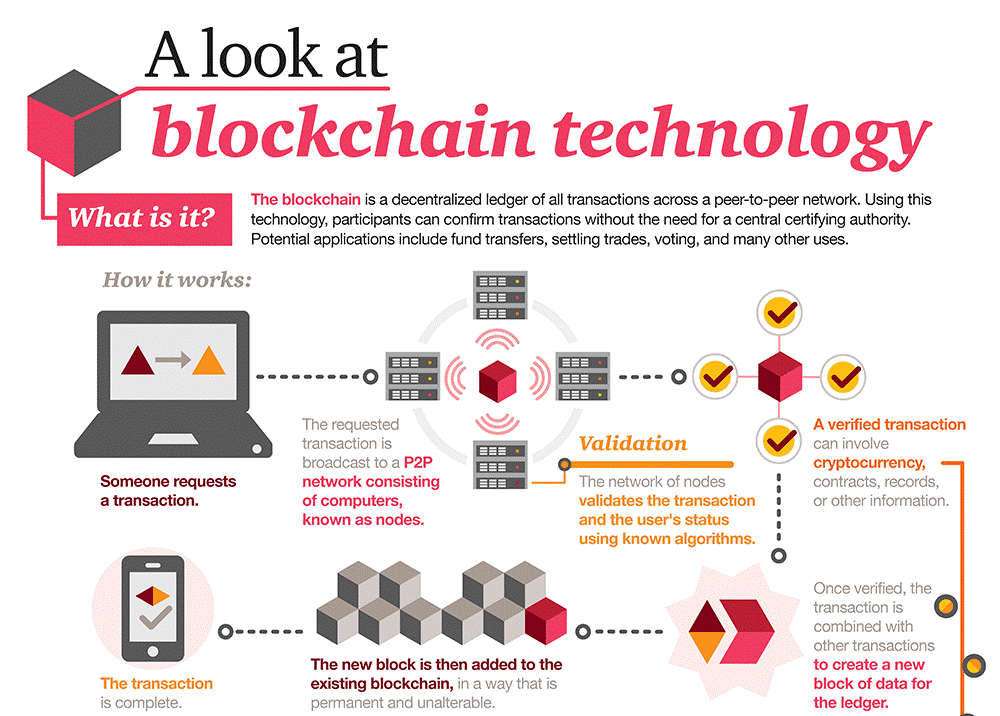

- Blockchain and Smart Contracts

- Cybersecurity in Finance

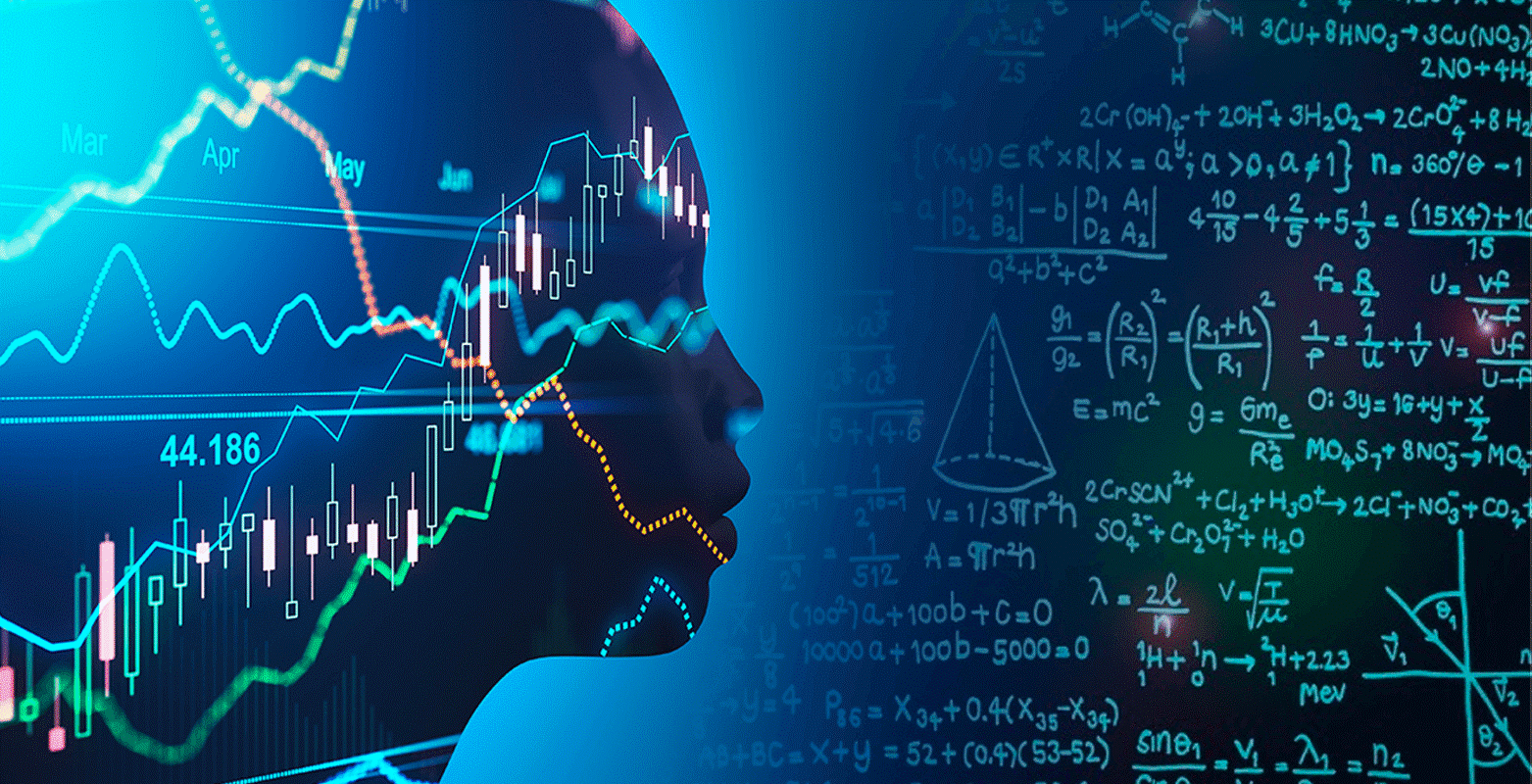

- Artificial Intelligence and Machine Learning in Finance

- Fintech Entrepreneurship

Digital Payments and Cryptocurrencies: This track delves into the world of digital currencies like Bitcoin and Ethereum, exploring blockchain technology and how it’s revolutionizing payment systems. Students learn about the mechanics of cryptocurrencies, the future of money, and the challenges of securing digital transactions.

Financial Data Analytics: This track emphasizes the importance of data in modern finance. Students learn to harness big data, use statistical tools, and apply analytics in financial decision-making, risk management, and forecasting. The focus is on transforming raw data into actionable insights.

Financial Software Development: In this track, students gain skills in programming and software engineering, specifically tailored to finance. They learn to develop financial applications, from trading platforms to financial management software, combining technical expertise with financial knowledge.

Risk Management and Compliance: This track covers the regulatory frameworks governing the financial industry. Students learn to navigate the complexities of financial laws, ensure compliance with regulations, and use technology to manage and mitigate financial risks effectively.

Investment Technology (WealthTech): Focusing on the intersection of technology and investment management, this track teaches students how technology is used to enhance investment strategies. Topics include robo-advisors, algorithmic trading, and the use of AI in portfolio management.

InsurTech (Insurance Technology): This track is dedicated to the technological advancements transforming the insurance industry. Students explore digital insurance platforms, automated underwriting processes, and the use of technology in risk assessment and customer service in the insurance sector.

Blockchain and Smart Contracts: Students in this track focus on blockchain technology’s potential to disrupt traditional financial systems. They learn about decentralized finance (DeFi), the creation and application of smart contracts, and the broader implications of blockchain on financial services.

Cybersecurity in Finance: This track addresses the growing importance of cybersecurity in protecting financial institutions. Students learn about the various threats to financial data, strategies for safeguarding against cyberattacks, and the technologies used to secure digital financial transactions.

Artificial Intelligence and Machine Learning in Finance: This track explores how AI and ML are reshaping the financial industry. Students study the development of predictive models, automated trading systems, and AI-driven customer service tools, gaining skills to apply these technologies in finance.

Fintech Entrepreneurship: Geared towards aspiring fintech entrepreneurs, this track covers the essentials of starting and managing a fintech business. Students learn about business planning, innovation strategies, and the unique challenges of launching a startup in the financial technology sector.

Expert Advisory From Industry

The Industrial Advisory Board would consist of industry leaders and experts from various domains within fintech, including:

- Financial Technology Executives: Senior professionals from leading fintech companies who can provide insights into current industry trends and technological advancements.

- Banking and Financial Services Representatives: Executives from banks and financial institutions who can offer perspectives on how fintech is transforming traditional banking and finance.

- Regulatory Experts: Individuals with expertise in financial regulation and compliance, ensuring the program aligns with industry standards and legal requirements.

- Entrepreneurs and Innovators: Successful fintech entrepreneurs who can share their experiences and guide students on starting and managing fintech ventures.

- Technology Experts: Professionals with deep knowledge of blockchain, AI, cybersecurity, and other relevant technologies who can ensure the program stays current with technological innovations.

- Academic Scholars: Renowned academics specializing in fintech, finance, and technology who can contribute to the academic rigor of the program.

- Venture Capitalists and Investors: Investors who focus on fintech startups, providing insights into funding, investment strategies, and what investors look for in fintech companies.

Platform

The Platform for the BS Fintech program would serve as a hub for students, faculty, and industry professionals to collaborate, learn, and innovate. Key components could include:

- Innovation Lab: A dedicated space where students can work on fintech projects, develop prototypes, and test new technologies. This lab would be equipped with the latest tools and software for fintech development.

- Industry Collaborations: Partnerships with leading fintech companies, banks, and financial institutions to offer internships, co-op programs, and real-world project opportunities.

- Fintech Incubator: A support system for students interested in launching their own fintech startups, offering mentorship, seed funding, and access to industry networks.

- Workshops and Seminars: Regularly scheduled events featuring industry experts, covering topics such as blockchain, AI in finance, regulatory challenges, and investment strategies.

- Hackathons and Competitions: Events designed to challenge students to develop innovative fintech solutions, often in collaboration with industry partners. Winners could receive prizes, internships, or startup funding.

- Career Development Services: A platform offering job placement assistance, resume building, interview preparation, and networking events specifically focused on the fintech industry.

- Research and Publications: Opportunities for students to engage in research projects and publish their findings in fintech journals or present at conferences, fostering a culture of academic excellence.

- Alumni Network: A strong, active alumni network that can provide mentorship, job opportunities, and industry connections for current students.

- Global Exchange Programs: Collaborations with international universities and fintech hubs that offer students the opportunity to study abroad, participate in global internships, and gain a broader perspective on fintech.

- Certification and Training Programs: Additional certification courses and professional training programs in areas like blockchain, AI, data analytics, and cybersecurity to enhance students’ skills and employability.